Unlocking New Possibilities: How Blockchain Powers Fractional Real Estate Ownership

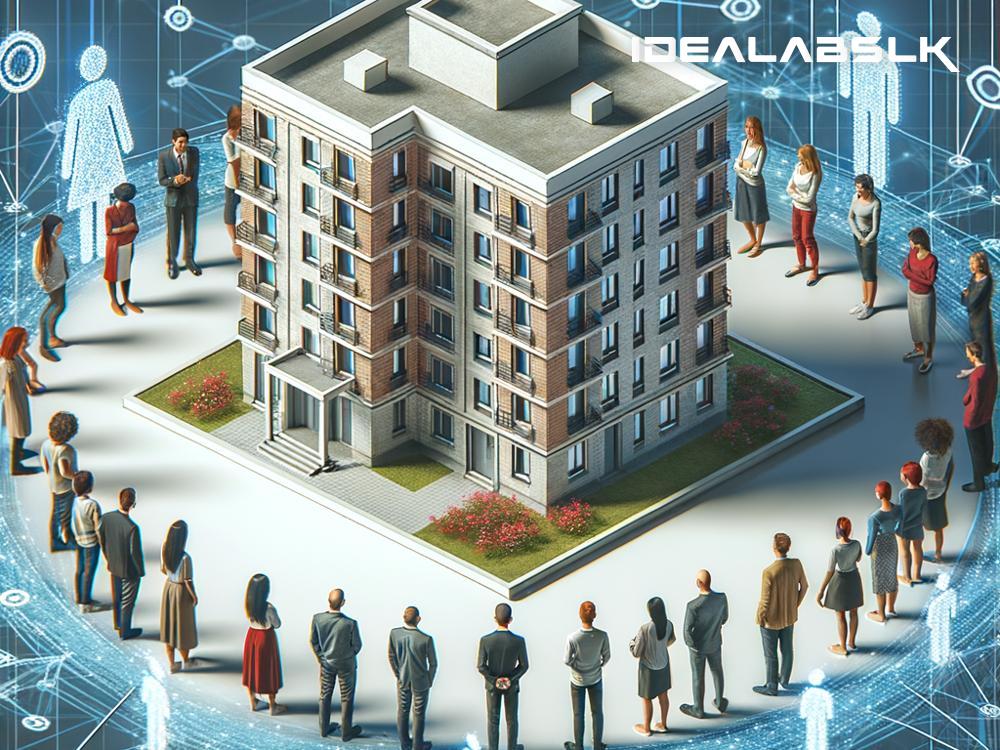

In the landscape of investment, real estate has perennially stood as a bastion of value and stability. However, it’s also been largely inaccessible to a significant portion of the population, thanks to the hefty sums needed to break into the market. Enter blockchain, a technological marvel that's redefining many sectors, real estate included. But how exactly does blockchain facilitate fractional real estate ownership, making it easier and more accessible for everyone? Let's dive into this fascinating development and unravel the magic behind it.

Breaking Down Blockchain

To understand how blockchain is revolutionizing real estate, we first need to grasp what it is. Imagine a digital ledger that's not stored in one central place but is instead distributed across a network of computers. This ledger records transactions in blocks, and once a block is filled with transactions, it’s linked to the previous block, creating a chain – hence the name, blockchain.

What makes blockchain extraordinary is its transparency and security. Once something is recorded, it can’t be altered without changing every subsequent block, which requires the consensus of the entire network. This makes fraud extremely difficult, fostering an environment of trust and accountability.

Traditional Real Estate vs. Fractional Ownership

Traditionally, buying real estate meant you had to purchase a whole property, a feat requiring substantial financial resources upfront. This has kept real estate investment out of reach for many, except for the wealthy or those willing to take on significant debt.

Fractional ownership changes the game. Instead of owning a property outright, you own a share of it, alongside other investors. This dramatically lowers the entry barrier, allowing more people to participate in real estate investment without needing deep pockets. However, managing such arrangements—especially with numerous investors involved—can be logistically challenging and costly...until blockchain came along.

How Blockchain Enables Fractional Real Estate Ownership

1. Tokenization

At the heart of blockchain's role in fractional ownership is a concept called tokenization. This involves converting the ownership of real estate into digital tokens on the blockchain. These tokens represent a share of the property and can be bought and sold easily. Suddenly, the cumbersome process of transferring real estate shares is as simple as sending a digital coin.

2. Smart Contracts

Blockchain uses smart contracts, which are self-executing contracts with the terms of the agreement directly written into lines of code. These contracts automatically enforce and execute the terms of agreements, like distributing rental income among token holders. This automation reduces the need for middlemen like lawyers or brokers, cutting down transaction costs and streamlining the process.

3. Transparency and Security

The decentralized nature of blockchain offers an unprecedented level of transparency and security. Every transaction is recorded on the blockchain, available for anyone to see, ensuring fairness and trust among investors. Additionally, the security protocols of blockchain reduce the risk of fraud, making investments safer.

4. Global Market

Blockchain makes it easier for people from different parts of the world to invest in real estate elsewhere. This opens up a global market, diversifying investment opportunities and spreading risk. No longer are investors limited by geographical constraints, as blockchain facilitates easy and secure transactions across borders.

The Impact on the Real Estate Market

The implications of blockchain-enabled fractional ownership are profound. For one, it democratizes real estate investment, making it accessible to a larger pool of investors. This could lead to more capital flowing into the market, boosting development and potentially making the market more dynamic.

Moreover, the efficiency and transparency blockchain brings can enhance liquidity in the real estate market. Properties that were once illiquid assets, difficult to sell without significant time and cost, can now be more readily traded through digital tokens.

In Conclusion

Blockchain is more than just the technology behind cryptocurrencies. It’s a transformative force in various sectors, with the power to make previously exclusive markets like real estate more accessible. Through fractional ownership, blockchain is not just changing how people can invest in real estate, but it's also making the entire market more transparent, secure, and efficient. As this technology continues to evolve, we can expect even more exciting developments in real estate and beyond, opening up opportunities that were unimaginable just a few years ago.